Did you know that shoppers who started their holiday hunt before November 2024 spent, on average, $250 more than those who waited? This isn't just a minor shift; it's a fundamental change in consumer behavior that presents a massive opportunity for savvy ecommerce creators. The traditional, frantic rush of Black Friday Cyber Monday (BFCM) is no longer the starting pistol for the holiday season—it's the home stretch. For businesses prepared to engage customers earlier, the rewards are significant: higher revenue, smoother operations, and more meaningful customer relationships. This guide will break down the data-driven strategies and psychological drivers you need to master early bird shopping in 2025, turning the extended season into your most profitable quarter yet.

Main takeaways

Here’s a snapshot of what you need to know to win the early bird shopping season:

The season is a quarter, not a month: The holiday shopping period now firmly begins in October. As retail analyst Anjali Mehta notes, "Brands that treat October as the new November will not only capture early demand but also build a data-driven foundation to optimize their core BFCM campaigns."

Early shoppers are high-value customers: Driven by a desire to spread out budgets and avoid stress, early shoppers are not just organized; they spend more overall.

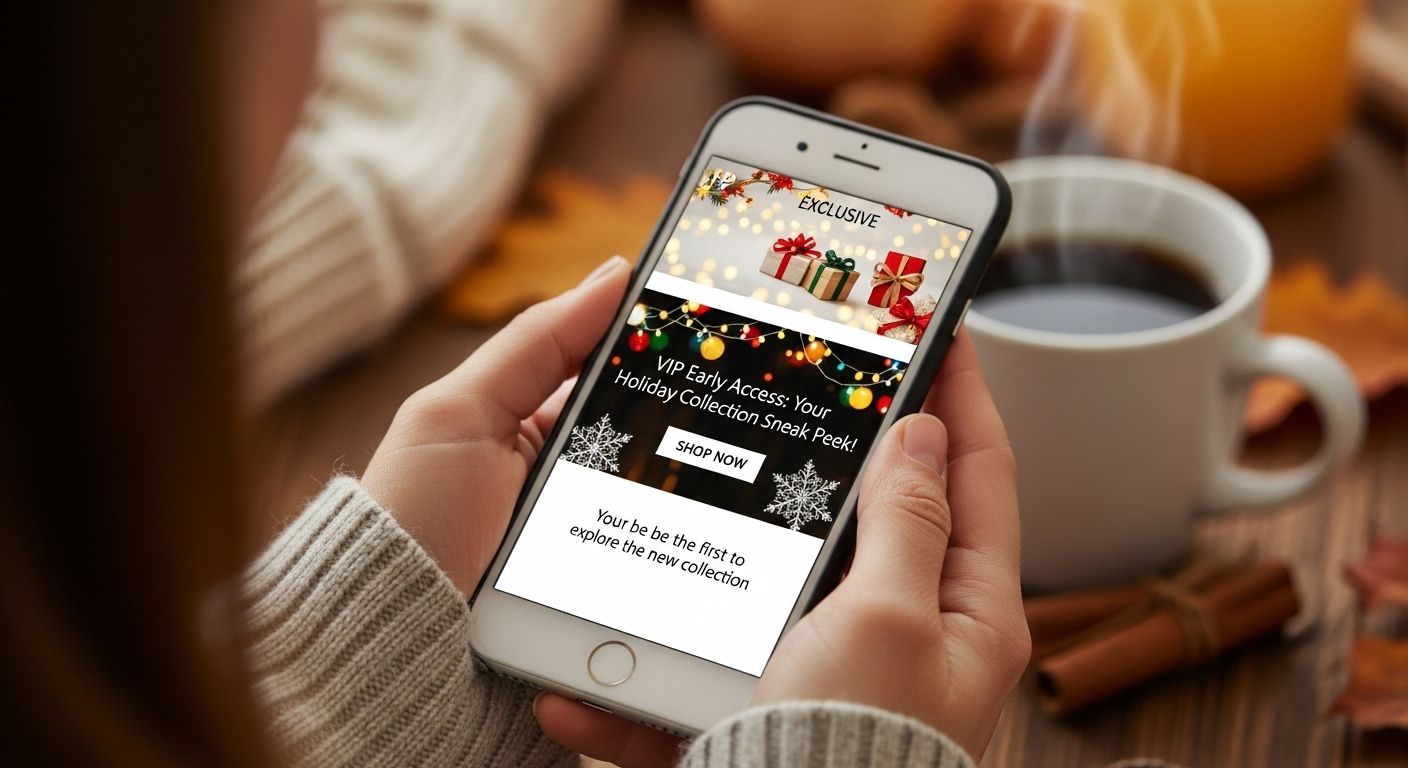

Exclusivity trumps generic discounts: Create urgency with themed events, VIP previews, and limited-edition bundles rather than just slashing prices early.

Focus on owned channels: Your email list and loyalty program members are your most valuable audience for early promotions. Targeted communication here yields the highest ROI.

Leverage production on demand: Mitigate inventory risk by using a service like Gelato. You can test new holiday designs for products like apparel and mugs without committing to costly bulk orders.

Data is your guide: Use performance data from your October and early November campaigns to make smarter, more profitable decisions for the BFCM peak.

The shift in holiday shopping: Why October is the new November

The days of holiday shopping being confined to the weekend after Thanksgiving are long gone. Data from the 2024 season paints a clear picture of a consumer base that plans, budgets, and purchases well in advance. According to the National Retail Federation (NRF), a staggering 59% of consumers began their holiday shopping before November. This isn't an anomaly; it's the new normal.

This behavioral shift is fueled by several key factors:

Budget consciousness: With 62% of early shoppers citing a desire "to spread out budgets" as their top motivator, according to Deloitte's 2024 Holiday Retail Survey, offering deals in October directly addresses a primary consumer pain point.

Stress avoidance: Consumers want to avoid the anxiety of last-minute shopping, shipping delays, and out-of-stock items. Shopping early gives them a sense of control and preparedness.

Retailer conditioning: Major sales events like Amazon's Prime Day sequels have trained consumers to look for deals in October, creating "mini-peak" shopping days that your brand can leverage.

The market impact is undeniable. U.S. online holiday spending hit $222.1 billion in November-December 2024, with early promotional activity helping drive a 5% year-over-year growth in global Cyber Week sales. For creators and ecommerce businesses, ignoring this early window is like leaving the first third of the race uncontested. To succeed, you must first understand the mindset of your target audience and then learn how to navigate ecommerce seasonality effectively.